Important City Tax, Budget, and Redistricting Information

Dear Neighbors,

Please take few minutes to read this important information that has been put together by Councilman Richard Jackson regarding the City Budget, Your Taxes and Redistricting.

I believe that Councilman Jackson did an excellent job in describing what the mayor and staff is trying to pull over on residents. My additional comments are in red.

After reading, I hope that you will consider attending the City Council meeting tomorrow evening at 6pm and let the mayor and council know how you feel about how they want to spend your money.

You can sign-up to speak by clicking this link: CITIZEN COMMENT (you have to sign up in advance per the mayor’s edict in order to be able speak at the meeting)

2022-2023 Proposed Budget (From Councilman Jackson)

As you know and are experiencing, skyrocketing property values are resulting in increased property taxes. It’s happening all over. Taxing authorities are benefitting from excess revenue. Last year, our City Council approved a 58.9₵ tax rate (same as prior year) knowing they would receive in excess of $1.9M directly from property tax revenue. This year, the 2022-23 proposed budget is taking the same approach but expected to net the city an additional $6.3M…a 16.3% increase in revenue over last year. The City can offset rising property tax appraisals by lowering the tax rate but that is not want they want to do.

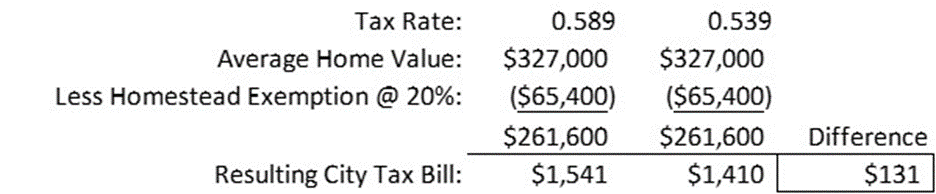

Taxpayers deserve to have some of their tax dollars returned. The budget attempts this by offering a 12-month 50% reduction to each household’s base water rate ($11 per month). This means each home, including rental homes, gets $132 over the course of one year. The “budget” touts this approach as equivalent to a 5₵ tax rate reduction to the average homeowner. Here is how they came up with that:

While I initially subscribed to this creative approach, after more research and consultation I now disagree with it. Here is why:

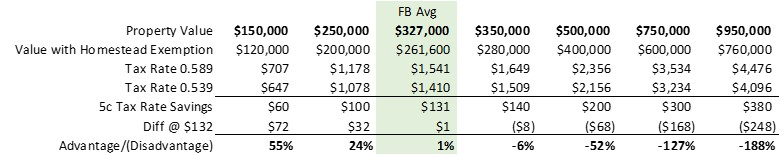

- It causes owners of properties valued more than $327,000 to subsidize windfalls for residents of properties valued less than $327,000. This also means that single-family renters would benefit from the water bill credit while owners would not. How can this be considered an equitable return of tax dollars? Below is a table to help you see where you fit into the scenario.

If your home’s value is $500,000, your credit is $68 (52%) less than what you would have received in an actual 5₵ tax rate reduction. Conversely, if your home is valued at $150,000, you would receive a $72 (55%) windfall.

- What about businesses? Businesses represent approx. 75% of our city’s property tax revenue. The budget proposal excludes businesses entirely from participating in any rebate. In my mind, this is like biting the hand that’s feeding you. What do you think? Some on council have said, why give businesses a tax reduction? Because it would help them invest in plant and equipment, hire more employees and reinvest in their business.

- The base water rate reduction approach is not a return of tax dollars. Rather, it’s a return of your dollars from the water/sewer fund because the city has accumulated an excess reserve water/sewer balance of $3M. This money belongs to residents OR it should fund aging infrastructure repairs/replacement. Did you know that 50% of Farmers Branch’s sewer and water lines are over 50 years old (clay tile, cast iron and asbestos cement)? Residents overpayment for water should be refunded, it’s their money. Tax rate should be lowered. These are two separate and independent issues.

- By not reducing the tax rate, the city is protecting its ability to raise the tax rate in future years without requiring voter approval. If the city reduces its tax rate now, it will create a lower tax rate “ceiling” in accordance with Senate Bill 2. Even if the city lowered its tax rate today, property owners will continue to pay more in taxes due to increased valuations. Remember- Dallas County Central Appraisal District caps valuation increases @ 10% per year. For how many years now have our property values increased more than 10%? According to Redfin, home values are up 16% in Dallas County. A July 30 Dallas News report said values were increasing as much as 25%. At this rate, it could take years for DCCAD to catch up to market value- all the while, the city benefits from additional revenue. What are your thoughts? When do residents get a break? Many cities are lowering their tax rates to combat the rapid rise in property valuations. The mayor, some council members and staff want to keep your money so they can fund wish-list items.

- We still have one of the lowest city tax rates in the metroplex, but that doesn’t justify excess fund balances and unnecessary spending. The city maintains a rainy day fund for emergencies, much like all of us. The policy is to maintain between 15% and 20% of annual expenditures. Today, that fund is approximately 30% ($4.4M overfunded). Our excess tax dollars should be refunded to us. That money is not the mayor or council’s slush fund to spend as they want.

IMPORTANT: While a tax rate reduction is a more equitable method of returning tax dollars to tax payers, it comes at a higher cost. The total cost of temporarily reducing the base water rate is approx. $1M. If the city were to instead reduce the tax rate by 5₵, the cost would be approx. $4M because it would include businesses. Good management oversight by astute Councilmembers like Richard Jackson and Omar Roman will help make sure your operational costs of the city are well managed and that your taxes are no higher than they have to be.

Other important matters/pressures regarding the proposed budget:

• Public Safety – A compensation study suggests that Farmers Branch should increase first responder salaries 6% (1% more than our +5% pay standard). The city is recommending 7%. Cities all around us are fighting for the same police officers and fire fighters. I am told that a 5-year DART officer now makes what our 20-year officers make. Other cities are planning to hire more and pay more. I suggest increasing police and fire salaries by 10% in this budget. It may sound like a lot, but its only an additional $600k for both police and fire. Compare that to what we are spending in other areas that do not contribute to our safety (i.e. a $500k overrun for Rec Center updates). A 10% increase will help us keep our best and attract the best. Alternatively, the cost of replacing a police officer is 40% (approx. $37k of a 5-year officer). A 10% salary increase is likely to save money in the long run by strengthening retention. How important is public safety to you? Councilman Jackson is exactly correct. We have to be more competitive and a 10% increase for front-line police and fire gets us there.

• Staff raises – 4.5% is proposed which means individual salary increases can range from 0% to 6%. Thoughts? I would propose a freeze on all management level salaries. Pay for department heads has gotten out of hand for a city of our size.

• 20-year retirement City ($4M) – Farmers Branch has sat on this for far too long. Farmers Branch and Richardson are the only 2 municipalities in the metroplex with a 25-year retirement plan; everyone else is 20-year. Richardson is budgeting to make the change this year, so we must as well. While it may only bring Farmers Branch to the minimum standard, it will help us compete with cities for quality talent. Part of the cost of this change could be paid for out of the money set for staff raises. Subtract the cost of the 20 year change and what is left is what would be available for raises.

• Aging Infrastructure – Our city has a rapidly growing need to replace aging water and sewer lines. We have done our best to keep up, however, Public Works Director Marc Bentley, expressed concern about the work and costs he foresees as these systems continue to age and risk failure in the near future. The message I got was that it presents the potential for a sudden big ticket cost. Yet, the budget proposes to take $1M from the $3M water/sewer reserve excess as a credit to residents labeled as a return of tax payer dollars. Does that give you concern? Robbing one fund to label it a “tax rate reduction” is a lie to the taxpayers. Please council, be truthful as to giving us our own money back.

• Parks spending – The city plans to move forward with replacing Oran Good park (Valley View Lane/Tom Field) with a neon-lit Joya Park at a cost of almost $5.5M. The bulk of this spending is coming from ARPA funds granted to Farmers Branch for COVID relief. The budget proposes $659k (11%) more for park maintenance. This, combined with some decreases in other areas, results in an overall $688k (5%) increase to the Culture & Recreation budget ($14,476,100). This budget includes big events, Branch Connection, Aquatics Center and the Manske Library. The mayor’s neon park is a “want”, not a need. We need to take care of streets, sewers and public safety before we spend $5.5 million on a park.

• Metrocrest Services is requesting an additional $230K beyond the $110k Farmers Branch allocated from ARPA funds in 2022 and $450k in 2023. The additional amount requested is earmarked to replace the loss of federal funding for rental assistance in Farmers Branch. While we can appreciate the job that Metrocrest Services does, it is not the job of council to give your tax dollars to charity. That should be your personal decision. Your tax dollars are supposed to be used for providing city services such as streets, water, sewers, police and fire safety.

Re-Districting

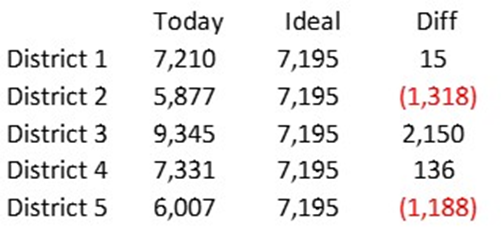

Three maps (click here) are being considered by Council. A public hearing is scheduled for this Tuesday, August 16 at 6pm at City Hall. Re-districting is required by our city charter every 10 years, subsequent to the US Census process. This is Farmers Branch’s first re-districting experience. The goal is for each voting district to consist of an equal number of residents (“1 resident = 1 vote”) while complying with the Voting Rights Act, our city charter, and minimizing legal risk regarding case law (i.e. Shaw v Reno). The chart below shows our current imbalance. Note that Districts 1 and 4 today are closest to the exact # of residents needed in each district without revision.

Districts 2, 3, 5 require adjustment to bring them in balance with the ideal 7,195 but you cannot do so without affecting Districts 1 and 4. Downsizing District 3 is a tall order given its size, location and all the applicable rules/guidelines, however, ALL 7 resulting commission maps unnecessarily and substantially disrupted Districts 1 and 3, conflicting with charter rule #2 “Communities of interest should be maintained in a single district, and attempts should be made to avoid splitting neighborhoods.” Below is my summary of each map under consideration.

MAP 7

• Presented/composed by a 15 FB resident Redistricting Commission (3 from each district), Chair Bronson Blackson, former City Councilmember

• Materially disrupts District 1 by dividing the Mercer Crossing neighborhood (disenfranchises Council Member Roman from many of his voters in his own neighborhood)

• Materially does not agree with FB Charter rule #2 (see above)

• Results in 2 minority majority districts

• District 2 has no multi-family composition (NOT a criteria, but a material factor)

• Attempts to plan for future growth in specific areas (NOT a criteria, but was promoted by the Chair and others)

MAPS 8 and 9

• Added versions from June 26 Council working session

• Avoids disrupting communities of interest and splitting neighborhoods (map 9 is slightly better)

o Map 8 divides communities of interest on 5 streets (keeping census blocks in tact forces splitting some “neighborhoods”)

o Map 9 has 3 splits, impacting fewer homes

• Minimal boundary disruptions; optimizes balance and compliance

• Results in 2 minority majority districts

• RESTORES communities of interest that are divided today (i.e. Brookhaven Country Club, Rawhide Park, Las Campanas/Glenside) by using major streets and creeks as natural dividers except for 2 small areas

• All districts share in multi-family composition

Council needs to vote on a new map by October. There will be 2 public hearings. I encourage you and any resident to go to the city’s re-districting site to view the maps.

Thank you again to Councilman Richard Jackson for putting together this excellent information.

If you have any questions about any of this, feel free to contact me or Councilman Jackson. Contact information is below.

Thank you,

Terry

Terry Lynne

Candidate for Mayor

214-244-1615

Richard Jackson

City Council Representative, District 4

469-855-5276